On-Demand Webinar | Running for Your Heart

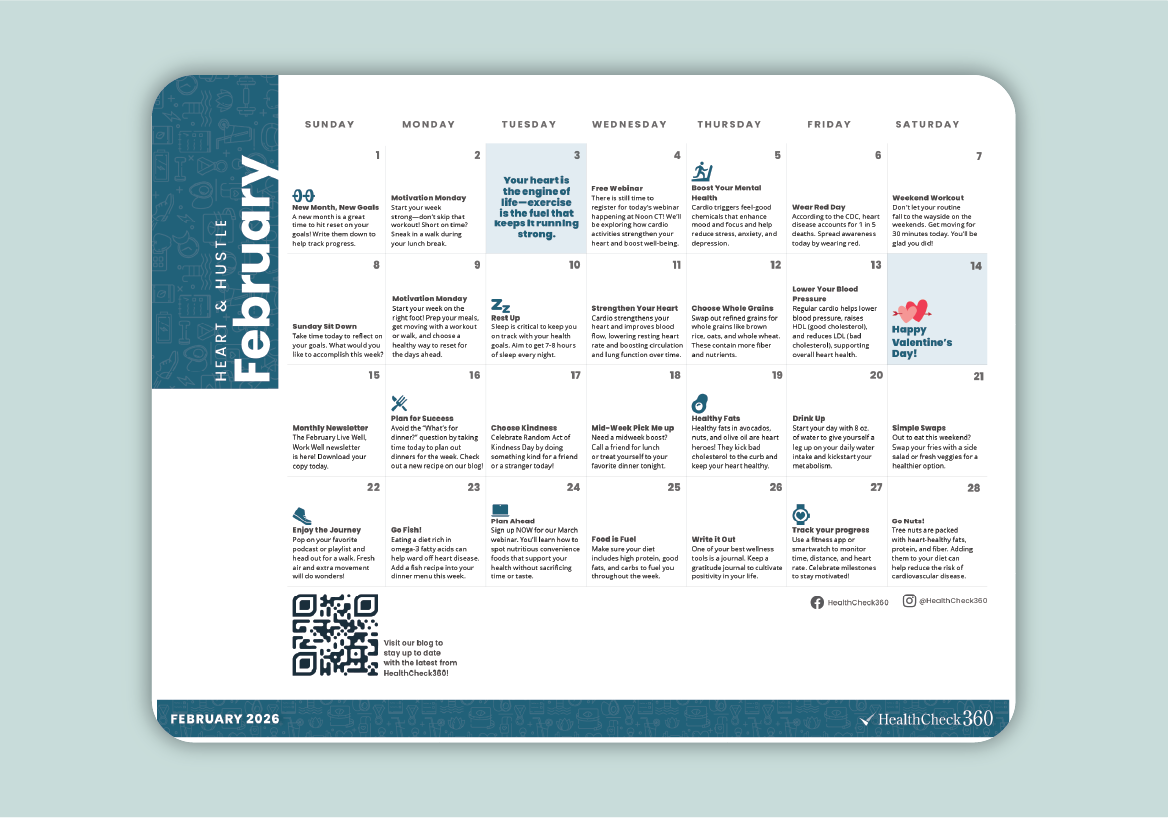

February is Heart Health Month—a perfect time to focus on the habits that keep your heart strong.

Health care costs continue to rise each year, and 2022 will likely be no exception. In the new year, experts predict a 6.5% increase in medical expenses alone, according to PricewaterhouseCoopers. In terms of health plan premiums, employers anticipate they may rise more than 5% in 2022, a Willis Towers Watson survey reports.

With these increases in mind, employers will want to strategize methods to rein in health care spending. This blog offers five ways to help.

1. Alternative Plan Modeling

One common method for reducing benefits costs is to increase employees’ share of expenses. This could be done directly through premium increases, but that might generate more problems for an employer; after all, many employees are still struggling financially and are ready to leave their jobs for better benefits options thanks to the COVID-19 pandemic.

Considering this, a more careful approach to lowering expenses may be through alternative plan modeling. Instead of a traditional health plan, employers can think about other plan designs that can still benefit employees without excessive costs. Plan modeling alternatives include:

Each of these plan modeling alternatives has advantages and disadvantages, depending on an organization’s unique circumstances. Employers should reach out to their benefits broker to learn more about the potential of these and other plan models.

2. Health Care Advocacy

HealthCheck360’s Advocacy program takes a proactive approach to encourage health plan savings for both your employees and your company. Through better health care navigation, our team of experts guide plan members to the lowest cost, but highest quality in-network providers, saving your company's health plan money. Plus, when Advocacy is used, around 30% of members choose less invasive or complex procedures. As a result, your company’s health plan costs are reduced while employees get the recommended, evidence-based care they need.

HealthCheck360's Advocacy program provides employees with a mobile-first solution to keep track of all their benefits, from medical and vision to health savings accounts and long-term disability. With our simple, intuitive tool, employees become better health care consumers because they know what benefits are available to them and are empowered to make better healthcare decisions.

3. Telemedicine Solutions

Telemedicine allows members to visit their doctor over the internet. Unsurprisingly, that made it extremely popular during the height of the COVID-19 pandemic.

According to McKinsey and Company, only 11% of U.S. consumers utilized telemedicine in 2019, pre-pandemic. As of mid-2021, 46% of consumers were using telemedicine to replace the in-person health visits they had originally planned. Additionally, 76% of consumers said they were interested in using telemedicine going forward, according to a separate McKinsey and Company survey.

Telemedicine is both convenient for your employees, while also a cost-savings tool for your company. HealthCheck360 can provide access to virtual mental health and telepsychiatry services through our partnership with MeMD, offering discounted rates and seamless integration through our myHealthCheck360 platform.

MeMD offers telehealth solutions across the country to more than 5 million members. Through a technology integration with HealthCheck360’s myHealthCheck360 platform, members are able to schedule a visit directly from their phone, mobile device, or computer. With a range of solutions from mental to physical health, members are able to receive the treatment that is right for them. Mental health support ranges from talk therapy to full psychiatry services, complete with prescriptions when medically necessary. Physical health support ranges from urgent care to primary care.

4. Prescription Drug Policy Revisions

Prescription drug offerings are great additions to health plans, but they can sometimes increase costs if not used properly. Specifically, employees will need to be educated about their drug plan, or they might spend money needlessly.

For instance, without adequate knowledge, an employee might opt for name-brand prescriptions each time they need one. The employee might not even know to ask their doctor about generic alternatives, which are equally effective and significantly more affordable. This can raise prices for everyone—individuals and their employers.

Beyond education, employers can help control needless drug spending by revising their policies or including HealthCheck360’s Medial Management support services as part of their plan. This may include requiring employees to request generic medications first before covering more costly alternatives or getting pre-certification on certain drug types to ensure the best medication, at the lowest cost is provided.

5. Chronic Condition Management

Condition management programs have been around for years, but at HealthCheck360, we take a different approach. We create a personalized experience that helps members stay compliant with their recommended care and improve their health, all while reducing costs for your health plan.

Around 80% of your healthcare spend is linked to members with a chronic condition, and members with a chronic condition are costing your plan 2.4 – 5.5 times more each year than members without a condition. Our clients have saved over $2,500 per enrolled member each year with an incentivized condition management program.

Most condition management programs ask employees to voluntarily sign up, leading to low enrollment rates of 20 - 40%at best. If your most at-risk employees aren't engaged, your company's health plan costs skyrocket. We take a data-driven approach to automatically enroll 100% of employees based on medical claims, prescription claims, biometric data, and referrals from other programs.

Incentivized condition management programs are shown to increase compliance rates by 29% and save companies an average of $2,500 per enrolled member, per year. Our flexible rewards solutions are built to fit your company’s culture, allowing you to reward compliant members with HRA and HSA contributions, insurance discounts, gift cards, testing supplies, and more. When employees are rewarded for achieving better health, everyone wins.

There are many approaches for controlling health care spending, but not all will work for each organization. That’s why it’s important for employers to closely analyze their health plan data and assess where they spend the most. This will help inform strategy and allow employers to maximize their efforts and bring in the right combination of programs that support employee health and lower costs, both in the near and long-term.

Reach out to HealthCheck360 to discuss cost-saving strategies that will fit your unique workforce.

February is Heart Health Month—a perfect time to focus on the habits that keep your heart strong.

February is the perfect time to inspire your team to focus on their health and build habits that last. Our February Well-Being Calendar is a simple,...

Empower your employees to find their “why” and drive lasting change with our January on-demand webinar!