On-Demand Webinar | Running for Your Heart

February is Heart Health Month—a perfect time to focus on the habits that keep your heart strong.

1 min read

HealthCheck360

:

Apr 22, 2019 8:31:00 AM

HealthCheck360

:

Apr 22, 2019 8:31:00 AM

Many people struggle with the idea of financial planning. Surveys reveal that as many as two-thirds of employees admit that worrying about their personal financial situations negativity affects their health. Help your employees improve their financial wellbeing by offering a financial wellness program.

Financial planning can be difficult for a number of reasons, especially when your employees don't have a budget, are not sure if they're on the right track for retirement savings, or simply don't know who to trust for advice.

What Can a Financial Wellness Programs Provide?

Financial wellness programs can help you employees with financial issues and decisions ranging from daily budgeting, long-term investment strategies, and even retirement savings. Financial wellness assistance can come in various formats:

It is important to make sure that the financial wellness programs you're offering fit your employee's needs. If you're looking for on-site, in-person financial wellness program, check out Retirewise offered by HealthCheck360 and MetLife. Offering financial wellness at your company doesn't have to be costly or time consuming. Learn more here.

Plus! Get this FREE poster to share with your employees now. It has easy tips for taking control of financial health and is ready to print!

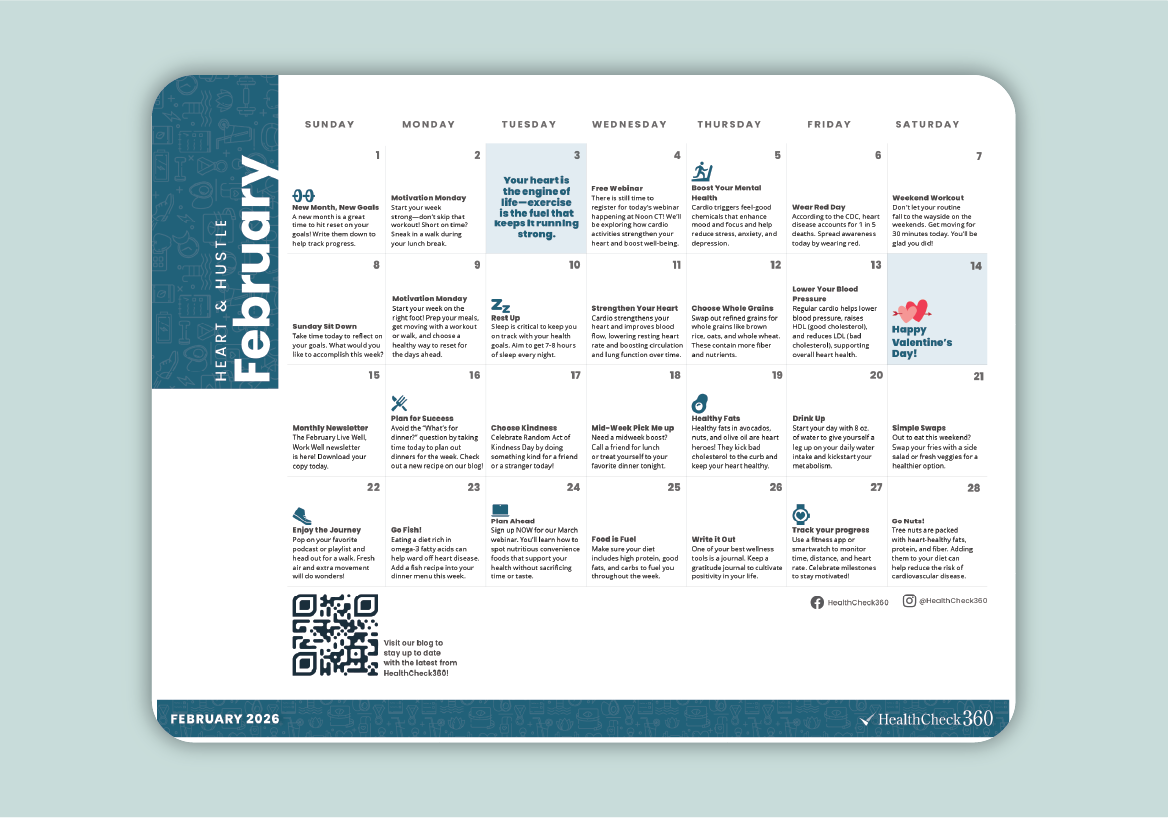

February is Heart Health Month—a perfect time to focus on the habits that keep your heart strong.

February is the perfect time to inspire your team to focus on their health and build habits that last. Our February Well-Being Calendar is a simple,...

Empower your employees to find their “why” and drive lasting change with our January on-demand webinar!